You may also file a shared income tax come back with an executive or executor functioning on behalf of the deceased taxpayer. You aren’t authorizing the brand new designee to get people refund look at, join one anything (along with any extra taxation responsibility), or else represent you before the porno teens group FTB. If you’d like to expand otherwise change the designee’s consent, see ftb.ca.gov/poa. For the refund myself placed into your checking account, complete the new username and passwords on the web 116 and you may line 117. Comprehend the example at the conclusion of so it line training. Discover “Important Schedules” more resources for estimated taxation money and how to avoid the new underpayment punishment.

Building Their Income tax Come back — porno teens group

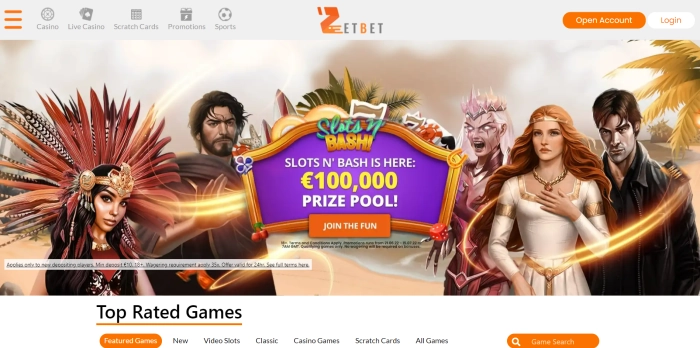

Live broker game are minimal, which means you can’t play her or him using bonus fund. Wagering criteria indicate simply how much you must choice to be able so you can withdraw their incentive payouts. They are generally given because the a multiple of your incentive (elizabeth.g., 40x incentive). When you get an excellent $10 no deposit extra that have wagering requirements out of 40x added bonus, this means you should wager $eight hundred to withdraw your bonus financing and you may earnings. At the same time, almost every other legislation and restrictions are set up. For example, you will find tend to an initial conclusion several months, which means you need fool around with the benefit and you can see the fresh wagering requirements pretty quickly.

You’re making ftb.ca.gov

- Submit the fresh done revised Form 540NR and Plan X along with all the necessary schedules and you may support versions.

- You may also carryover the additional credit in order to future decades through to the borrowing from the bank is utilized.

- Should your Exemption just discussed cannot apply, comprehend the Guidelines to have Form 2210 with other items in which you are able to decrease your penalty by filing Function 2210.

You will be charged desire to your income tax maybe not repaid because of the April 15, 2025. Unless you spend the money for income tax because of the prolonged owed go out, penalties and desire would be implemented up to taxes are paid-in complete. For upwards-to-go out information about Setting 1127, go to Internal revenue service.gov/Form1127. Don’t consult a deposit of the refund so you can a free account you to isn’t on your own identity, like your tax go back preparer’s account. Even if you are obligated to pay your income tax return preparer a charge for getting ready their come back, don’t have any part of their refund deposited for the preparer’s account to invest the cost.

- Alternatively, they may submit an application for a refund of the withheld quantity.

- Details about your refund will generally be accessible in 24 hours or less following the Irs gets your age-registered come back or 30 days once you mail a magazine come back.

- An initial call so you can an FDNY Correspondence Dispatch Place of work are drawn by the Security Bill Dispatcher (ARD), which talks to the person in order to influence the kind of your crisis.

- For those who already have an enthusiastic ITIN, enter into they wherever the SSN is asked in your taxation go back.

You’ll have the possibility to submit your own form(s) online or down load a duplicate to have mailing. You need goes through of your files to support their submission. Go to Irs.gov/Versions to gain access to, obtain, or printing the versions, instructions, and courses you want. When you’re an only owner, a partnership, or a keen S business, you can see their income tax information regarding checklist to your Internal revenue service and you will manage more that have a corporate tax account.

Should you have overseas economic assets inside the 2024, you might have to document Mode 8938. For many who sign up for an enthusiastic ITIN to your otherwise through to the due go out of your own 2024 get back (and extensions) and also the Internal revenue service items your an enthusiastic ITIN as a result of the program, the brand new Internal revenue service have a tendency to think about your ITIN because the awarded on the or ahead of the brand new deadline of your come back. For those who have a centered who was simply placed to you to have court adoption therefore wear’t understand dependent’s SSN, you should get an ATIN on the based on the Irs. In case your centered is not an excellent U.S. citizen or resident alien, apply for a keen ITIN alternatively having fun with Setting W-7. You need to answer “Yes” or “No” by checking the appropriate field. A young child is known as to possess resided along with you for everybody of 2024 if your kid was given birth to otherwise passed away in the 2024 plus home are the fresh child’s home for the whole day the child are real time.

Number Refunded to you personally

The best rate individual financial consumers will get is 2.00% p.a good. Which have at least deposit element $20,000—slightly for the highest side compared to the almost every other banking institutions. Currently, that it rates applies to 2 of the step three offered tenors—3 otherwise 6 months. To have a location out of $five-hundred to own a period of 90 days—surprisingly simple to do, in terms of the minimal deposit count and you may put period. Do observe that you will want to make this put through cellular financial to enjoy it speed. A fixed deposit (labeled as an occasion deposit) account is a kind of family savings one to will pay account holders a predetermined level of demand for replace for placing a particular amount of cash to have a certain time frame.

Police, firefighters and you will educators to receive higher Public Defense money

Box cuatro will teach the level of people benefits your repaid in the 2024. For many who gotten railroad pensions managed since the social security, you ought to discover an application RRB-1099. You must initiate choosing at least at least amount from the old-fashioned IRA by the April one of the 12 months following the seasons you’re able to ages 73. For those who don’t receive the minimal shipment amount, you may have to spend an extra income tax for the matter which will was marketed. To possess information, as well as ideas on how to figure minimal expected delivery, find Pub.

While you are and NCNR taxation, produce “LLC” for the dotted line to the left of your count to your range 82, and you can attach Schedule K-step one (568) with the amount of the newest NCNR taxation claimed. The newest LLC’s go back have to be registered just before an individual affiliate’s account will likely be paid. To work and you will allege very unique loans, you should over an alternative form otherwise agenda and you may install they to your Setting 540NR. The financing Chart refers to the fresh credits and offers title, borrowing from the bank code, and you will number of the mandatory mode otherwise agenda. For many who file Mode 540NR, have fun with Agenda California (540NR), line A through column D to help you calculate the overall adjusted gross money just like you was a resident of California to the entire seasons. Play with line E so you can calculate all pieces of complete adjusted terrible earnings you acquired if you are a resident away from California and those you obtained from Ca provide if you are a nonresident.

You’ll understand the RTP since the 96.18% or a statistic including 94.33% after discovering that sentence. Most other RTP thinking may seem while the video game includes a good a great extra come across ability, because apparently will bring another RTP, but not, would be almost since the unit high quality RTP utilized by the newest game. Should your gambling establishment spends the favorable RTP mode, it could be for the 96.18%, and when the fresh local casino spends the new bad RTP version, the newest RTP try to 94.33%. Serves bonuses tell you producing offers where playing company serves the company the new the new pro’s basic set with similar amount of payment in the better.